Welcome to the World of Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currency pairs in the global market. As one of the largest and most liquid financial markets in the world, Forex trading offers numerous opportunities for traders to profit from the fluctuations in currency prices. Whether you’re a beginner or an experienced trader, understanding the fundamental concepts of Forex is crucial for success. You can find a variety of trading platforms and resources to help you navigate this dynamic market at forex trading website https://kuwait-tradingplatform.com/.

Understanding Forex Basics

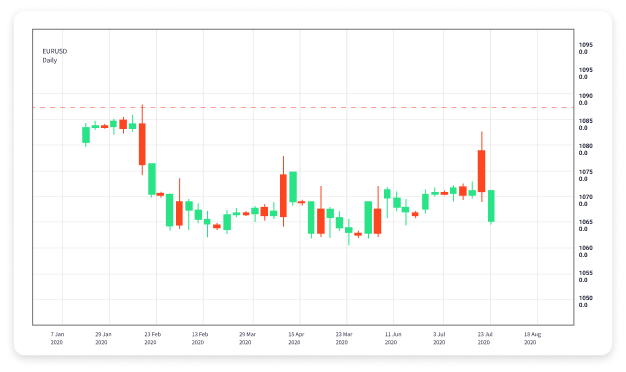

At its core, Forex trading involves the exchange of one currency for another. Currency pairs are quoted in terms of a base currency and a quote currency. For example, in the pair EUR/USD, the Euro (EUR) is the base currency, while the US Dollar (USD) is the quote currency. Traders speculate on whether the base currency will strengthen or weaken against the quote currency, which determines their trading strategy.

The Mechanics of Forex Trading

Forex trading is conducted over-the-counter (OTC), meaning that trades are executed directly between parties without a centralized exchange. This allows for continuous trading 24 hours a day, five days a week. Trading takes place in various global financial centers, including London, New York, Tokyo, and Sydney, creating substantial market liquidity and enabling traders to execute trades rapidly.

Types of Forex Markets

The Forex market can be categorized into three main types:

- Spot Market: The spot market is where currencies are bought and sold at the current market price. Transactions occur immediately, or “on the spot.”

- Forward Market: In the forward market, traders enter into contracts to buy or sell currencies at a predetermined price on a future date. This allows traders to hedge against price fluctuations.

- Futures Market: Similar to the forward market, the futures market involves standardized contracts that are traded on exchanges. Futures contracts have specific expiration dates and contract sizes, making them suitable for speculative trading.

Key Participants in the Forex Market

The Forex market is made up of various participants, including banks, financial institutions, corporations, and retail traders. Each participant plays a distinct role in the market:

- Central Banks: Central banks, such as the Federal Reserve in the United States, influence currency values through monetary policy and interest rate adjustments.

- Commercial Banks: Commercial banks facilitate currency transactions for their clients and participate in the Forex market for their accounts.

- Hedge Funds: Hedge funds engage in Forex trading to yield returns and hedge against other investments.

- Retail Traders: Individual traders participate in the Forex market to profit from currency price fluctuations. With the advent of online trading platforms, access to the Forex market has become easier for retail traders.

Forex Trading Strategies

To navigate the complexities of the Forex market successfully, traders employ various strategies. Here are a few popular trading approaches:

- Day Trading: Day traders open and close positions within the same trading day to capitalize on short-term price movements.

- Swing Trading: Swing traders hold positions for several days or weeks to profit from anticipated price changes.

- Scalping: Scalpers make numerous trades throughout the day, aiming to earn small profits from each trade.

- Position Trading: Position traders take long-term trades based on fundamental analysis and macroeconomic factors.

Risk Management in Forex Trading

Effective risk management is vital for maintaining a healthy trading account. Traders should consider the following techniques:

- Set Stop Loss Orders: Stop-loss orders automatically close a position at a predetermined price to limit potential losses.

- Risk-Reward Ratio: Assessing the risk-reward ratio helps traders determine the potential return of a trade compared to the risk they are taking.

- Diversify Your Portfolio: Diversifying currency pairs can help reduce risk by mitigating the impact of adverse price movements in a single position.

- Only Trade with Capital You Can Afford to Lose: It’s essential to trade with capital that won’t negatively impact your financial situation.

Choosing a Forex Broker

Selecting a reputable Forex broker is one of the most critical decisions a trader will make. Consider the following factors when choosing a Forex broker:

- Regulation: Ensure the broker is regulated by a recognized authority, which provides a level of protection for your funds.

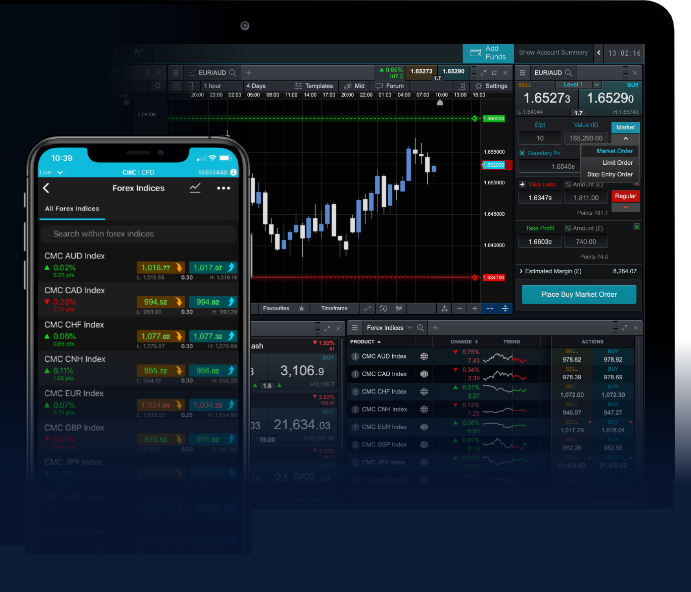

- Trading Platform: Evaluate the trading platform’s features, usability, execution speed, and tools available for analysis.

- Fees and Spreads: Compare the commission fees and spreads among different brokers to choose a cost-effective option.

- Customer Support: A reliable broker should offer robust customer support to assist with any issues or inquiries.

Resources for Forex Traders

There is an abundance of resources available for Forex traders, including:

- Online Courses: Many platforms offer educational courses for beginners and advanced traders alike, covering various trading strategies and best practices.

- Trading Blogs and Forums: Engage with the trading community through blogs, forums, and social media to exchange insights and learn from others’ experiences.

- Market Analysis Tools: Utilize technical analysis tools and economic calendars to stay informed about market trends and news events.

- Trading Simulators: Use demo accounts and trading simulators to practice trading strategies without risking real money.

Conclusion

Forex trading offers exciting opportunities for those willing to learn and adapt to the market’s intricacies. By understanding the fundamentals of Forex, employing effective trading strategies, and managing risks wisely, traders can navigate this dynamic financial landscape effectively. As you embark on your Forex trading journey, remember to stay informed and continuously seek knowledge through various available resources. Happy trading!