Best Candlestick Patterns for Binary Trading

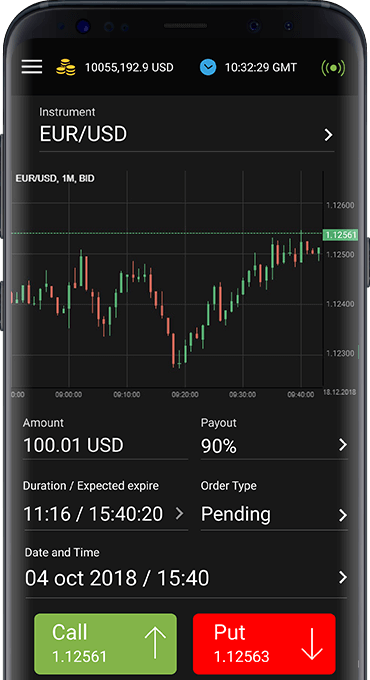

In the world of trading, understanding the dynamics of price movement is crucial, especially in best candlestick patterns for binary options best binary options. One of the most effective methods for analyzing price movements is through candlestick patterns. These visual representations of price action can provide traders with insights into market sentiment and potential reversals. In this article, we will explore some of the best candlestick patterns that every binary options trader should master.

What are Candlestick Patterns?

Candlestick patterns are visual formations created by the open, high, low, and close prices of an asset over a specific time period. Each candlestick represents a timeframe, which can range from minutes to hours and even days, depending on the trader’s strategy. By analyzing these patterns, traders can gauge market sentiment and predict future price movements.

Why are Candlestick Patterns Important for Binary Options Trading?

Candlestick patterns are particularly important in binary options trading due to the short timeframes associated with trades. A well-timed prediction based on a candlestick pattern can lead to substantial profits. Moreover, understanding these patterns helps traders to identify entry and exit points more accurately, making informed decisions that align with market trends.

Key Candlestick Patterns to Know

1. Doji

The Doji is a significant candlestick pattern that occurs when the open and close prices of an asset are virtually equal. This pattern indicates indecision in the market, signaling that buyers and sellers are at a stalemate. A Doji can suggest a potential reversal, especially when found at the top or bottom of an uptrend or downtrend.

2. Hammer

The Hammer is a bullish reversal pattern that appears at the end of a downtrend. It has a small body and a long lower shadow, indicating that buyers stepped in after sellers pushed the price down. If a Hammer forms in a downtrend, it can signify the potential for a price reversal, making it a valuable indicator for traders.

3. Inverted Hammer

Similar to the Hammer, the Inverted Hammer is also a bullish reversal pattern, but it appears at the bottom of a downtrend. This pattern indicates that buyers are attempting to push the price up after a significant drop. Traders should look for confirmation of the reversal with subsequent bullish candlesticks before entering a trade.

4. Engulfing Patterns

Engulfing patterns can be either bullish or bearish. A Bullish Engulfing Pattern occurs when a small bearish candle is followed by a larger bullish candle that completely engulfs the previous candle. This pattern indicates a potential reversal from a downtrend to an uptrend. Conversely, a Bearish Engulfing Pattern does the opposite, suggesting a reversal from an uptrend to a downtrend.

5. Shooting Star

The Shooting Star is a bearish reversal pattern that appears after an uptrend. It has a small body and a long upper shadow, indicating that buyers pushed the price up, but sellers eventually took control, driving the price back down. This pattern can signal a potential market reversal, providing traders with the opportunity to enter a short position.

6. Evening Star

The Evening Star is a reliable bearish reversal pattern composed of three candlesticks. It begins with a bullish candle, followed by a small-bodied candle (which can be a Doji), and concludes with a bearish candle that closes below the midpoint of the first candle. This pattern suggests that the buyers are losing momentum and that a downtrend may follow.

7. Morning Star

In contrast to the Evening Star, the Morning Star is a bullish reversal pattern formed after a downtrend. It consists of three candlesticks: a bearish candle, a small-bodied candle, and a bullish candle that closes above the midpoint of the first candle. This formation indicates that the sellers are relinquishing control, making it a promising entry point for bullish trades.

How to Use Candlestick Patterns in Binary Options Trading

To effectively utilize candlestick patterns in binary options trading, traders should follow these guidelines:

- Look for Confirmation: Always wait for confirmation from subsequent candles before placing a trade based on a pattern. This helps reduce the risk of false signals.

- Combine Patterns with Other Indicators: Enhance your analysis by using candlestick patterns alongside other indicators, such as moving averages or Relative Strength Index (RSI), to confirm trends.

- Focus on Timeframes: Choose the appropriate timeframe for your trading strategy. Shorter timeframes are crucial for binary options, as they allow for faster decision-making.

- Keep a Trading Journal: Document your trades, including the patterns you observed and the outcomes. This practice will help you refine your strategy over time.

Conclusion

Mastering candlestick patterns is essential for successful binary options trading. By recognizing and understanding these patterns, traders can predict market movements more effectively and make informed decisions. Although no strategy guarantees success, combining candlestick analysis with sound risk management techniques can improve your chances of winning trades. Begin practicing these patterns in a demo account, and once you gain confidence, you can confidently apply them in live trading scenarios.