Forex trading, also known as foreign exchange trading, is a global market where currencies are bought and sold. It is one of the most active and lucrative markets in the world, where traders engage in the exchange of different currencies aiming to make a profit. With advancements in technology and a rise in online trading platforms like forex trading explained FX Trading UZ, accessing the Forex market has become easier than ever. This article will explain Forex trading in detail, covering its basics, strategies, risks, and how to get started.

What is Forex Trading?

The term “Forex” stands for “foreign exchange.” Forex trading involves the simultaneous buying of one currency and selling of another. The market operates round-the-clock, five days a week, enabling traders to react quickly to market changes. Unlike stock markets, which have specific opening and closing times, Forex markets are decentralized and exist as a global network of banks, financial institutions, brokers, and retail traders.

How Does Forex Trading Work?

Forex trading occurs in currency pairs, where one currency is quoted against another. The first currency in the pair is known as the base currency, and the second is called the quote currency. For instance, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency. The price reflects how much of the quote currency is needed to purchase one unit of the base currency.

Forex trading involves various market participants, including central banks, financial institutions, corporations, hedge funds, and retail traders. Retail traders often access the market through brokers, which provide platforms for trading. These brokers earn money through spreads—essentially a markup on the currency price—or by charging commissions on trades.

Forex Trading Strategies

Successful Forex trading requires the use of effective strategies tailored to individual trading styles. Here are some common strategies:

1. Scalping

Scalping is a short-term trading strategy where traders aim to make small profits from quick trades. Scalpers typically make dozens or even hundreds of trades in a single day, capitalizing on small price movements.

2. Day Trading

Day trading involves taking positions within a single trading day, usually closing all trades by the end of the day to avoid overnight risks. Day traders rely on technical analysis to make quick decisions.

3. Swing Trading

Swing trading is a medium-term strategy where traders hold positions for several days or weeks to profit from expected price movements. Swing traders often use both technical and fundamental analysis to decide when to enter and exit trades.

4. Position Trading

Position trading is a long-term strategy where traders hold positions for months or even years. This strategy is often based on fundamental analysis and macroeconomic factors impacting currencies.

Understanding Forex Charts

Charts are essential tools for Forex traders as they provide a visual representation of currency prices over time. The most common types of charts include:

1. Line Charts

Line charts show the closing prices of a currency over a specified time and are useful for highlighting overall price trends.

2. Bar Charts

Bar charts provide more detailed information, displaying the open, high, low, and close prices for a specified time period, allowing traders to understand price movements better.

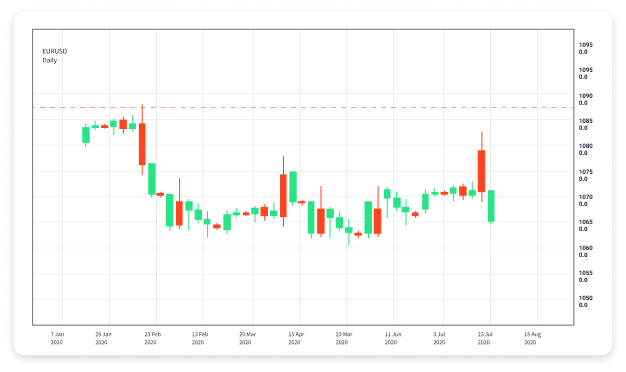

3. Candlestick Charts

Candlestick charts are popular among traders due to their ease of interpretation. Each candlestick represents price movements for a specific period and provides insights into market sentiment.

Risks of Forex Trading

While Forex trading offers opportunities, it also involves significant risks. Some of the risks include:

1. Market Risk

Market risk is the possibility of losing money due to unfavorable price movements. Currency pairs can be volatile, and prices can change rapidly, leading to potential losses.

2. Leverage Risk

Forex trading often involves leverage, allowing traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it also increases the potential for losses, which can exceed the initial investment.

3. Counterparty Risk

Counterparty risk is the risk of the other party in a transaction not fulfilling their obligations. This risk can be mitigated by choosing reputable brokers and financial institutions.

Getting Started with Forex Trading

To begin Forex trading, follow these steps:

1. Educate Yourself

Prior to starting, educate yourself about the Forex market, trading strategies, and technical and fundamental analysis. Many online resources, courses, and webinars are available to help you learn.

2. Choose a Reputable Broker

Select a Forex broker that is regulated and offers a user-friendly trading platform. Ensure the broker fits your trading style and offers reasonable spreads and commissions.

3. Practice with a Demo Account

Most brokers offer demo accounts, allowing you to practice trading with virtual money. Use the demo account to develop your skills and test your strategies without any financial risk.

4. Start with a Trading Plan

Create a detailed trading plan that outlines your trading goals, risk tolerance, and strategies. A well-defined plan helps you stay disciplined and avoid emotional trading decisions.

Conclusion

Forex trading can be a rewarding venture for those willing to learn and invest time into understanding the market. By mastering trading strategies, understanding market analysis, and managing risks, traders can enhance their chances of success in this dynamic environment. Remember to start with a solid foundation of knowledge and practice before engaging in live trading. With the right approach and resources, Forex trading can become both a profitable and fulfilling pursuit.