What is Forex Trading?

Forex trading, also known as foreign exchange trading or currency trading, involves the buying and selling of currencies in the global marketplace. It is one of the largest financial markets in the world, with a daily trading volume exceeding $6 trillion. Forex trading is not only for large financial institutions but is also accessible to individual traders who wish to capitalize on currency fluctuations. For more comprehensive insights and resources about Forex trading, visit what is forex trading https://acev.io/.

How Forex Trading Works

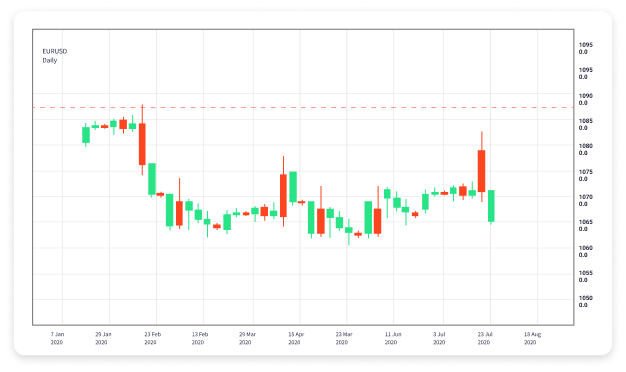

Forex trading is conducted in currency pairs, such as EUR/USD or GBP/JPY. When you trade a currency pair, you are essentially betting on the future movement of one currency relative to another. If you believe that the Euro will strengthen against the US Dollar, you would buy the EUR/USD pair. Conversely, if you think the Euro will weaken, you would sell that pair. Forex trading occurs 24 hours a day, five days a week, due to the global nature of the market.

The Forex Market Participants

The Forex market is diverse, with various participants playing unique roles. Major players include:

- Central Banks: National banks that control currency supply and interest rates.

- Commercial Banks: Facilitate currency transactions for clients and trade on their behalf.

- Corporations: Engage in Forex trading for international business transactions and hedging against currency exposure.

- Institutional Investors: Include hedge funds and pension funds that trade currencies for profit.

- Retail Traders: Individual traders who speculate on currency movements.

The Mechanics of Forex Trading

When trading Forex, understanding the mechanics can significantly influence your success. Key components include:

- Currency Pairs: The base currency is listed first, and the quote currency is listed second. For example, in the EUR/USD pair, Euro (EUR) is the base and US Dollar (USD) is the quote.

- Bid and Ask Price: The bid is the price at which you can sell a currency pair, while the ask is the price at which you can buy it. The difference between the two is known as the spread.

- Leverage: Many Forex brokers offer leverage, allowing traders to control larger positions with a smaller amount of capital. While it can amplify profits, it also increases risk.

- Margin: This is the amount of money required to open and maintain a leveraged position. Traders need to be cautious with margin to avoid liquidation of their account.

Forex Trading Strategies

Traders develop various strategies to navigate the Forex market effectively. Here are a few well-known approaches:

1. Day Trading

Day trading involves executing multiple trades in a single day, focusing on short-term movements. This strategy requires constant market monitoring and quick decision-making.

2. Swing Trading

Swing trading, on the other hand, aims to capture shorter-term price moves over several days or weeks. Swing traders often rely on technical analysis to identify potential entry and exit points.

3. Position Trading

Position trading is a longer-term strategy where traders hold their positions for weeks, months, or even years. This approach typically involves a macroeconomic analysis to gauge broad trends.

4. Scalping

Scalping involves making rapid trades to lurk for small price changes. This strategy demands immense focus and quick reflexes, as trades are held for only a few seconds to minutes.

The Importance of Risk Management

Risk management is vital in Forex trading. Traders should define their risk tolerance and use tools such as stop-loss orders to limit potential losses. It is advisable not to risk more than 1-2% of the trading capital on a single trade to preserve overall capital and sustain in the long run.

Challenges and Risks in Forex Trading

While the opportunities in Forex trading are substantial, the risks are equally significant:

- Market Volatility: The Forex market can be highly volatile, with rapid price fluctuations that can result in substantial losses.

- Leverage Risks: Although leverage can amplify gains, it can equally amplify losses. Traders should be cautious and use leverage responsibly.

- Lack of Regulations: Many Forex brokers operate outside of regulated environments. Traders should thoroughly research their chosen broker and ensure they are compliant with regulations.

- Emotional Trading: Emotional reaction to market movements can lead to impulsive decisions, hindering success. Establishing a trading plan and adhering to it is crucial for emotional control.

Conclusion

Forex trading presents opportunities for substantial profits as well as significant risks. Aspiring traders should invest time in education, develop a robust strategy, and prioritize risk management. Understanding the mechanics of the Forex market, along with the factors influencing currency movements, is key to navigating this complex financial landscape successfully. With continued practice and discipline, one can possibly master the art of Forex trading.